Select Portfolio Highlights

Upcoming Acquisition: Off-Market 204-Unit Multi-Family Gem In The Hot Lubbock Texas Market

Why we love this opportunity:

Following our successful acquisitions in North Carolina, we are excited to announce our entry into the thriving Texas multifamily market

- Off-Market, stabilized, Class A asset, acquired at 18% below an appraisal dated April 2025: no heavy value-add risk

- No reliance on aggressive rent growth. CBRE shows 4% YoY rent growth between 2020 and 2024, despite 4,000 new units delivered; we are basing our annual increase on 3%

- Despite the appraisal validating $270 premium above in-place rents, our plan includes a $50 rent bump year2 and $100 year 3

- Median household income of $83,733 within a 3-mile radius of the property. Compared to an average rent of $14,100 in year 1 (only 16.8% of household income) and$17,796 by year 5

Download The Deck

Current Offering — PC Fund II

Finding Value In Undiscovered Markets

Asset Class:

Multifamily

Offering Size:

$50,000,000

Preferred Return:

8%

LP-GP split:

80%/20%

Fund Term:

5 Years

Target Annualized Return:

17%-22% Average Annual

Multiplier:

2x to 2.2x in 5 Years

Select Portfolio Highlights

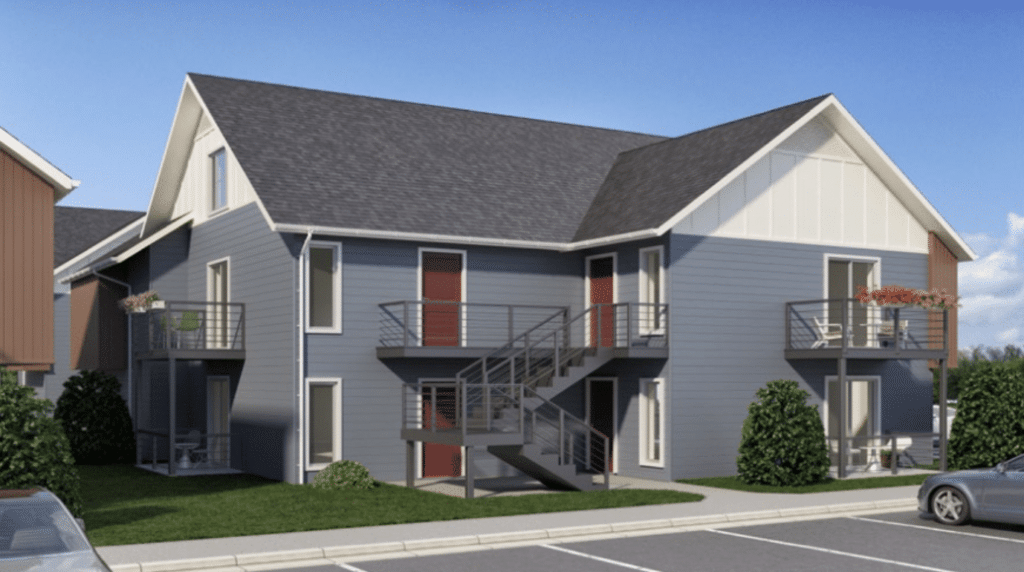

Spring Forest at Deerfield

Mebane, North Carolina

192 units, Class A

VIEW THE CASE STUDY