Asset Class: Multifamily Core+/Value-Add

Offering Size: $50,000,000

Preferred Return: 8%

LP-GP split: 80%/20%

Fund Term: 3-5 Years

Target Annualized Return: 17%-22% Average Annual

Multiplier: 2x+ in 5 Years

Asset Class: Multifamily Core+/Value-Add

Offering Size: $50,000,000

Preferred Return: 8%

LP-GP split: 80%/20%

Fund Term: 3-5 Years

Target Annualized Return: 17%-22% Average Annual

Multiplier: 2x+ in 5 Years

Penn Capital is a vertically integrated real estate investment firm focusing on multifamily in carefully selected markets based on our research. We are defined by our data driven, proprietary market selection process, conservative underwriting, technology-backed, in-house property management, construction management, and fund management expertise.

Our investment partners include institutions, family offices, independent advisors and our principals. We have built a network of local contacts that real estate generalists cannot match.

Real estate markets in gateway cities like Phoenix, Las Vegas and Dallas are too crowded to offer significant value.

We invest in multi-family real estate in a small number of up-and-coming MSAs where we expect much higher returns before they appear on the institutional radar.

Percy is responsible for investor relations and capital raising. Before starting Penn Capital, he was an avid investor in private equity deals, as well as commercial and residential real estate, giving him valuable insights into the needs of our investors.

He has held executive-level leadership roles in the financial services and Pharma industries, including at Merrill Lynch, Dow Jones and Pfizer. He has also been a successful entrepreneur, having founded and exited successful tech companies. He has a bachelors degree Computer Science and Computer Systems Engineering from Western Michigan University.

Ed is responsible for sourcing new acquisitions and generating deal flow, underwriting deal feasibility, analyzing market trends, and engaging resources in the capital markets.

Before founding Penn Capital, Ed was a successful sales and marketing director for a publicly traded company in the oil and gas industry. His sales experience helps Penn build loyal relationships with debt lenders, enabling it to secure attractive loan terms.

He also served in the U.S. Army with the 82nd Airborne Division and spent one year in Afghanistan, where he led his team in multiple combat missions.

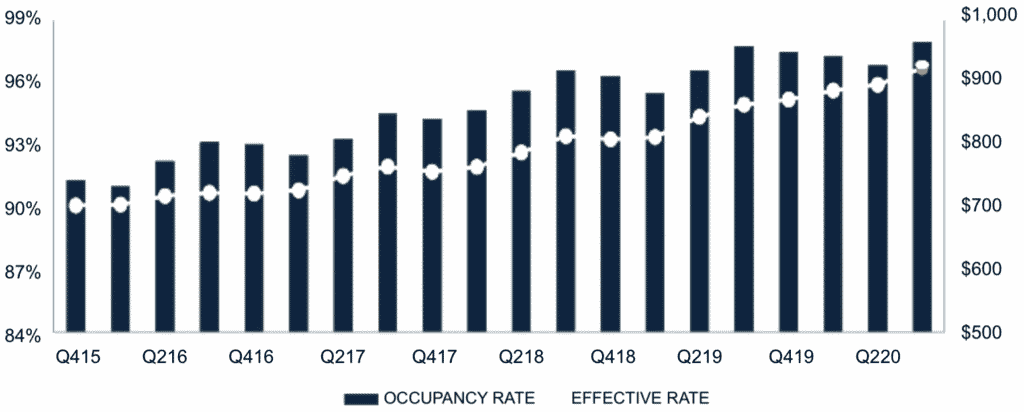

A young, educated population

Tremendous job growth

High Income, Low Median Rent

A business friendly environment attracting diverse, reputable employers

population

$2.3 billion invested, 4,000 jobs

$1 billion invested, 600 jobs

$750 million invested, 100 jobs

$600 million invested, 75-100 jobs

$349 million invested, 500+ jobs

$1 billion invested, 4,000 jobs

$142 million invested, 2,000 jobs

$220 million invested, 650 jobs

200-300 jobs

$200 million invested, 342 jobs

Assets Under Management:

$185+MM

Minimum Investment:

$50,000

Syndications:

9

Units Owned

1,200+

$ Generated for Investors

20+MM

575 E Swedesford Rd, ste 101, Wayne, PA 19087

Prepared by Penn Capital LLC in relation to the proposed opportunity in their company (hereinafter also referred to as “the Company” or “Penn Capital”).This does not constitute an offer in any jurisdiction to any individual to whom such an offer would be unlawful in such jurisdiction. We have not authorized any individual to provide any information or to make any representations except to the extent contained herein. If any such representations are given or made, such information and representations must not be relied upon as having been authorized by Penn Capital LLC. This is not an offer to sell or subscribe, nor is it seeking an offer to buy shares, in any jurisdiction where the offer or sale is not permitted. Prior to making any investment decision, you should determine, without reliance upon Penn Capital LLC, the economic risks and merits, as well as the status of legal, tax, and accounting matters pertaining to the Company and determine whether the high-risk nature of any investment is acceptable to the recipient. This document contains forward-looking statements and financial and other projections that are subject to risk and uncertainty that could cause the actual results to differ from those projected, including but not limited to price fluctuations, environmental risks, physical risks, legislative and regulatory changes, political risks, project delay or advancement, the ability to meet additional funding requirements, factors relating to title to properties, native title, dependence on key personnel, approvals, and cost estimates.

© Penn Capital Group. All Rights Reserved • Privacy Policy