5 Real Estate Tax Strategies to Enhance Your Legacy

By Percy Nikora, Owner, Co-Founder

This is the time of the year when many of us write large checks to the IRS.

While I have not come across anyone complaining that they want to pay more than their fair share of taxes, it does surprise me that many intelligent, high net worth individuals and even some independent advisors are not familiar with the tremendous power of tax saving strategies that can help compound their net worth, leading to an increase in their family’s generational wealth and legacy.

The US tax code is written to incentivize certain behavior such as investments in a particular sector, or providing housing, which by some estimates is 4 million units short of what is needed today (with no immediate change on the horizon).

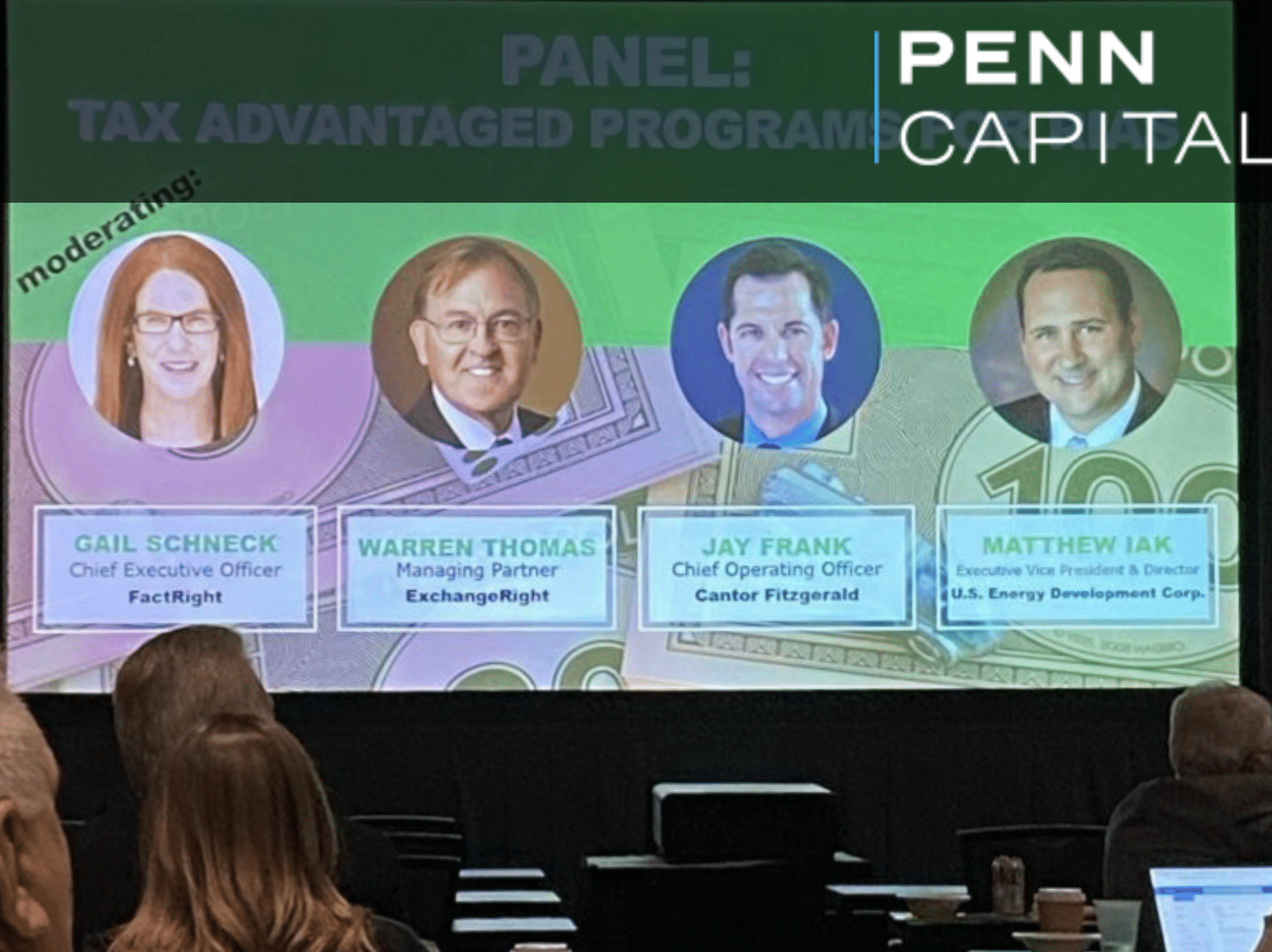

Recently, I attended a conference of over 150+ Registered Investment Advisors (RIAs) in Scottsdale, AZ, where there was a discussion of the power of tax advantaged real estate investments and given the pain some readers may feel while writing large checks to the IRS, I thought this may be an opportune time for a reminder on the powerful tax benefits of real estate.

The US tax code is written to incentivize certain behavior such as investments in a particular sector, or providing housing, which by some estimates is 4 million units short of what is needed today (with no immediate change on the horizon).

Real Estate Tax Benefits

Many wealth managers and investment advisors love the tax benefits their High Net Worth clients and Family Office clients get from real estate investments, particularly multifamily:

- Accelerated Depreciation and Bonus Depreciation – At Penn Capital, we conduct a Cost Segregation Study on our portfolio properties that essentially deconstructs each floor plan into its individual components (e.g. flooring, countertops, appliances, electrical fixtures, etc) which allows our accountants to depreciate it in as little as 5-7 years vs the typical 27.5 year of “straight-line” depreciation for multifamily buildings. This often creates a “paper loss” that offsets or shelters the income generated by the property, that would typically be taxed at a higher rate. This depreciation benefit is passed on to the investor-partners on the K1. This “tax loss” can also be used against other passive income. When the asset is sold, there is depreciation recapture but that is capped at a lower rate than the typical income for a high-income earner, based on current IRS rates.

- Use of Qualified Retirement Funds – Due to the gigantic marketing budgets of brokers and mass media, not everyone is aware that they can invest their retirement funds in alternative assets not correlated to the stock market (like real estate) through a self-directed retirement account such as a SD-IRA, SD-Roth IRA or Solo 401k. This allows your investment to grow and compound at a much higher rate over time.

- 1031 Exchange – One of the most powerful sections of the tax code is Section 1031 aka “Like kind exchange of real property” that allows you to sell and exchange one investment property for another while continuing to defer the capital gains, thus allowing your investment to grow faster. One benefit, if it can be called that, is when the owner of that property passes away, the owner’s heirs will get a stepped-up basis that could eliminate the deferred capital gains.

- Qualified Opportunity Zones - This investment opportunity was created through the 2017 Tax Cuts and Jobs Act, encouraging economic development in defined low-income areas or zones. One can defer eligible capital gain tax (from a variety of sources) by investing in a QOZ through a qualified opportunity fund (QOF). This program allows a step-down in the capital gain taxes at defined intervals until all of it is wiped out after 10 years.

- Installment Sales – This strategy allows you to spread out the capital gains over time and is typically used to manage your income tax bracket for the given year.

Savvy investors can use a combination of the strategies above and leverage the legal tax incentives provided by the US government to grow their generational wealth and leave behind a larger legacy.

Sign up to receive our educational newsletter and to gain exclusive access to our next investment opportunity.

Penn Capital is a vertically integrated real estate investment firm that acquires, operates, and sells multifamily apartment complexes for a profit. Our portfolio consists of 1000+ units in the South and Southeast of the US in nimble high-growth markets that fly below the radar.

If you would like to learn more about Penn Capital, please feel free to schedule a free 20 minute call here.

RELATED ARTICLES

5 Keys to Investing in Distressed Real Estate

5 Keys to Investing in Distressed Real Estate By Ed Rogan, Owner, Co-Founder Buying distressed real estate certainly isn’t for the faint of heart. An inexperienced investor can easily be swayed by the promise of a project sponsor who doesn’t actually have a plan for turning the property around. But that doesn’t mean you shouldn’t…

READ MORE >Gaining an Edge through Cold Calling

Gaining an Edge through Cold Calling By Ed Rogan, Owner, Co-Founder In many ways, commercial real estate is an “eat what you can kill” industry. The most successful investors, developers, brokers and other CRE professionals earn their living by scouring the market to uncover the next big deal. Ask the industry’s best and they’ll often…

READ MORE >Trial by Fire: How We Got Started

Trial by Fire: How We Got Started By Ed Rogan, Owner, Co-Founder People often use the term “trial by fire” to explain how they learned something. In our case, the term is all too appropriate. Looking back on it, the story of how Percy and I got started almost seems unbelievable. We were just…

READ MORE >